Description

The client, a leading private university, faced increasing pressure to grow student enrollment opportunities year-over-year while managing a diverse marketing mix and flat marketing budget.

Over the past few years, they have diversified their media mix — investing in traditional TV and Print alongside digital channels. Despite multi-channel efforts, the university marketing team lacked visibility into what drove enrollment opportunities.

The Client encountered several key challenges:

- Attribution Ambiguity: There was no unified way to assess the effectiveness of different channels. Traditional media metrics such as clicks and impressions didn’t provide sufficient insight into the enrollment process.

- Budget Misalignment: The marketing team identified the need for a testing budget and room for platform experimentation to address new audiences. Much of the marketing budget was committed to traditional media (e.g. TV and Print) based on historical buying preferences and needed optimization.

- Seasonal Blind Spots: The university’s enrollment cycle followed academic seasonality (e.g., application deadlines, open days), but campaign timing often didn’t align optimally with these windows.

- External Noise: External factors like tuition changes, economic shifts, and demographic trends weren’t accounted for in campaign evaluation, skewing perceptions of success or failure.

Ultimately, leadership wanted to answer two critical questions:

- What channels are the most significant contributors to enrollment opportunities?

- How can we spend more efficiently to increase enrollments, reduce overall cost per enrollment, and identify additional channels for experimentation?

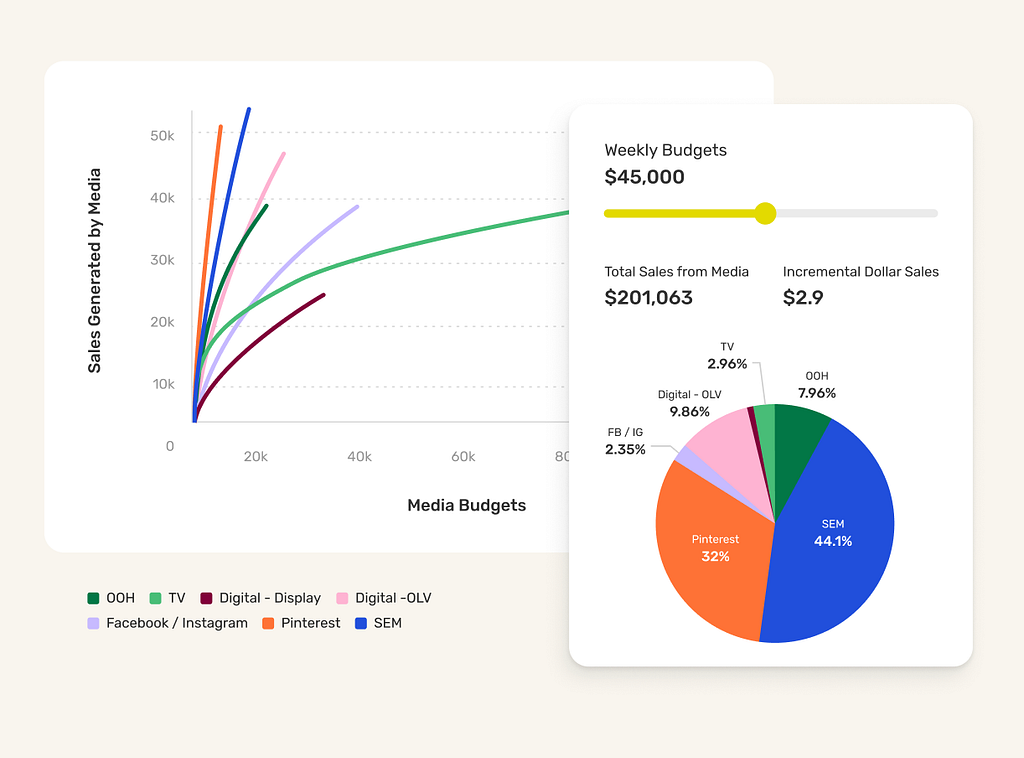

To solve this, the Client turned to the Marketing Mix Modeling (MMM) module with Arima to create a unified, data-backed view of marketing effectiveness.

Insights

- Identified top-performing digital channel tactics

- Non-brand keywords in SEM and Conversion tactics on Meta and LinkedIn drove the lowest CPA on enrollment opportunities.

- Social media has historically been underfunded compared to other marketing mix channels.

2. TV and Print are long past the point of diminishing returns.

- Historically, it provided strong awareness, especially within the regional market, but it is weak on direct conversions and does not cover much of the ground nationally and internationally.

- Over-saturation led to reduced marginal impact.

- Spend reduction can create much-needed room for new channel experimentation.

3. There is great synergy between paid social and local on-campus promotions.

- Prospects exposed to owned (email, events) and paid media were twice as likely to enroll.

- This valuable insight creates an excellent opportunity to capitalize on during the next campaign.

4. Looking to optimize spending timing

- Peak activity occurred during spring, yet Q3 is the largest spend period.

- Adstock takes around 3 weeks to peak on most marketing channels.

- Allows for better planning, pre-activation a few weeks in-advance and redistribution of the spending throughout the year.

Impact

- Rebalanced the Media Mix

- Shifted 25% of budget away from TV and print toward digital channels and testing with 50/50 split in funds.

- Increased investment in retargeting and testing.

- Launched additional experiments with net-new Social media channels and local OOH

2. Optimized around enrollment windows

- Concentrated 60% of paid media in the spring season, aligned with academic milestones.

- Introduced conversion-focused touchpoints post-events reflected in creative CTAs strategies.

3. Elevated First Party Media through marketing synergy opportunities

- Built cross-channel campaigns (email + digital + open house events).

- Justified CRM and content investment using MMM data.

4. Aligned Stakeholders Around ROAS (CPA-focus)

- Unified measurement frameworks cross teams (admissions, marketing, finance) around MMM findings.

- Used insights to guide annual planning and budget allocation.

5. Tested Localized Pilots

- Launched geo-targeted campaigns in low-performing markets.

- Tailored channel strategy to local behavior and demographics.

Result

Optimized marketing mix reflected in 30% increase in enrollment opportunities for the next campaign and 18% YoY growth in total applications. On average, the client saw a monthly increase in enrolled students at 10% above the target rate.